Table of Contents

- 2025 snapshot: who thrives with code-first trading

- Core practices shared by successful code-driven traders

- Minimal working example: momentum crossover with slippage

- Quickstart: research-to-live pipeline (Python)

- Pitfalls to avoid

- Performance notes (Python focus)

- What “successful” looks like in practice

- Tiny FAQ

2025 snapshot: who thrives with code-first trading

This 2025 update focuses on patterns shared by consistently profitable, code-driven traders rather than name-dropping. Across equities, futures, FX, and crypto, the winners leverage disciplined research pipelines, robust execution, and risk-first thinking.

Archetypes and where Python fits:

| Archetype | Horizon | Edge | Python’s role |

|---|---|---|---|

| Mid-frequency stat-arb | minutes–days | cross-sectional mean reversion, pairs, spreads | research, backtests, orchestration |

| Trend/momentum swing | days–weeks | time-series momentum, breakouts | signal research, portfolio, risk mgmt |

| Options/vol traders | intraday–weeks | skew/term structure, event hedges | data prep, analytics, risk scenarios |

| Crypto quant | seconds–days | funding basis, cross-exchange, microstructure | data ingestion, execution orchestration |

| Market-making/HFT | sub-ms–minutes | microstructure, queue position | Python for research; C++/Rust in the loop |

Key takeaway: Python dominates research, prototyping, portfolio construction, and glue logic. Live execution at very low latency may use faster languages, but Python still coordinates systems and risk.

Core practices shared by successful code-driven traders

- Data discipline: clean, timestamped, survivorship-bias-free, corporate actions adjusted, and timezone-aware.

- Reproducible research: notebooks for EDA; scripts for batch runs; versioned datasets and code; parameter sets logged.

- Robust backtesting: walk-forward splits, realistic slippage/fees, latency modeling, and stress scenarios.

- Risk management: position sizing, volatility targeting, hard stops/soft stops, portfolio limits, kill-switches.

- Execution quality: smart order placement, throttling, partial fills, and venue-aware costs.

- Monitoring: metrics, health checks, drift detection, alerting, and incident runbooks.

- Change control: small, reviewable releases; feature flags; paper-trade canary before full rollout.

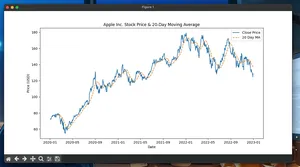

Minimal working example: momentum crossover with slippage

A compact, vectorized backtest with basic costs and risk notes. Replace synthetic data with your feed later.

# Minimal Momentum Crossover Backtest (Python 3.10+)

import numpy as np

import pandas as pd

# 1) Synthetic price series (business days)

np.random.seed(7)

dates = pd.date_range('2018-01-01', '2024-12-31', freq='B')

noise = np.random.normal(0, 0.001, size=len(dates))

trend = 0.0001 # weak upward drift

ret = trend + noise

price = 100 * np.exp(np.cumsum(ret)) # log-normal path

df = pd.DataFrame({'close': price}, index=dates)

# 2) Strategy: fast/slow MA crossover (long-only)

fast, slow = 20, 80

df['ma_fast'] = df['close'].rolling(fast).mean()

df['ma_slow'] = df['close'].rolling(slow).mean()

# Signal: long if fast > slow

signal = (df['ma_fast'] > df['ma_slow']).astype(int)

# Position starts next bar to avoid look-ahead

pos = signal.shift(1).fillna(0)

# 3) Returns, costs, and equity

raw_ret = df['close'].pct_change().fillna(0.0)

slippage = 0.0002 # 2 bps per entry/exit

commission = 0.0005 # 5 bps per trade side

cost_per_turn = slippage + commission

turnover = pos.diff().abs().fillna(pos.abs()) # 1 on enter/exit

strategy_ret = pos * raw_ret - turnover * cost_per_turn

# 4) Metrics

cum = (1 + strategy_ret).cumprod()

peak = cum.cummax()

drawdown = (cum / peak - 1.0)

def ann_factor(idx):

# Approx. trading days per year

return 252 / (len(idx) / ((idx[-1] - idx[0]).days / 365.25)) if len(idx) > 1 else 0

ann_mult = np.sqrt(252)

sharpe = strategy_ret.mean() / (strategy_ret.std(ddof=1) + 1e-12) * ann_mult

cagr = cum.iloc[-1] ** (252 / max(1, len(strategy_ret))) - 1

maxdd = drawdown.min()

trades = int(turnover.sum())

print(f"Trades: {trades}")

print(f"Total Return: {cum.iloc[-1]-1: .2%}")

print(f"CAGR: {cagr: .2%}")

print(f"Sharpe (ann.): {sharpe: .2f}")

print(f"Max Drawdown: {maxdd: .2%}")

# 5) Tiny risk tweak: volatility targeting (optional)

# Target 10% annualized vol; scale daily exposure

vol_target = 0.10

roll_win = 30

daily_vol = raw_ret.rolling(roll_win).std().fillna(method='bfill') * np.sqrt(252)

scale = (vol_target / (daily_vol.replace(0, np.nan))).clip(upper=3).fillna(0)

position_vt = (pos * scale).clip(-1, 1) # cap leverage

ret_vt = position_vt * raw_ret - turnover * cost_per_turn

cum_vt = (1 + ret_vt).cumprod()

print(f"Vol-targeted Total Return: {cum_vt.iloc[-1]-1: .2%}")

What this covers:

- No look-ahead: positions activate next bar.

- Costs: simple slippage and commission deducted on each trade.

- Risk: optional vol targeting to stabilize variance.

Next steps: swap synthetic data with your vendor/broker feed; parameterize MAs; add walk-forward validation.

Quickstart: research-to-live pipeline (Python)

- Define the hypothesis

- Example: “Fast-over-slow momentum in large-cap equities with realistic costs.”

- Acquire and clean data

- Use adjusted prices; align calendars; de-duplicate; enforce monotonic timestamps.

- Build a vectorized backtester

- Start with pandas/NumPy; ensure reproducibility (seeds, versions, configs).

- Add realistic frictions

- Slippage model (bps), fees, borrow costs (shorts), corporate actions, halts.

- Validate properly

- Train/validation/test splits; walk-forward; purged k-fold; parameter risk checks.

- Stress and scenario test

- Shocks, volatility regimes, gaps, missed fills, API downtime.

- Paper trade

- Same code path as live; log fills, slippage, PnL, latency, errors.

- Deploy cautiously

- Start with small capital; circuit breakers; hard position/sector/asset limits.

- Monitor and iterate

- Dashboards for PnL, exposure, turnover, costs, drift; alerts on anomalies.

- Maintain

- Version data and code; changelogs; rollback plan; post-mortems.

Pitfalls to avoid

- Overfitting and data snooping: too many parameter sweeps without proper validation.

- Look-ahead/peeking: using future info (e.g., close-to-close signals without shifting).

- Survivorship bias: testing only current index constituents.

- Underestimating costs: optimistic fills, zero impact, no borrow fees.

- Latency/clock drift: mismatched clocks cause bad order timing.

- Regime dependence: strategies die when microstructure or volatility shifts.

- Operational fragility: unhandled exceptions, no retry/backoff, missing heartbeats.

Performance notes (Python focus)

- Prefer vectorized NumPy/pandas; avoid row-wise loops in hot paths.

- Precompute and reuse arrays; minimize allocations inside loops.

- Use numba for tight custom loops; Cython only if stable APIs.

- Batch I/O; memory-map large arrays; cache transformations.

- Asynchronous I/O for feeds and orders (asyncio); bound concurrency carefully.

- Log efficiently (structured, leveled); avoid chatty logs in hot paths.

- Profile first: cProfile, line_profiler; fix the top two hotspots before micro-optimizing.

What “successful” looks like in practice

- Small, compounding edges: high capacity to execute cleanly beats rare big wins.

- Stable drawdown profile with controlled tail risk and auto-deleveraging.

- Consistent monitoring and quick rollback on anomalies.

- Continuous research pipeline shipping small, tested improvements.

Tiny FAQ

- Do I need machine learning to compete? Often no. Clean signals + risk + execution beats overfit ML. Add ML only when you can justify data edge and controls.

- Can I do live trading entirely in Python? Yes for many mid/high-latency strategies. For ultra-low latency, pair Python research with a faster execution layer.

- How much capital do I need? Enough to cover diversification and costs with buffer. Costs and slippage dominate at small size; market impact dominates at large size.

- Which broker/exchange API should I use? Choose based on asset class, reliability, order types you need, and fee structure. Prioritize stability and monitoring support.

- How do I estimate slippage? Start with bps assumptions by liquidity bucket, then calibrate using paper/live fills. Update as regimes shift.

Disclaimer: For educational purposes only; not investment advice.