Why risk management matters

Algorithmic strategies live or die by how they size positions, cap losses, and survive volatility spikes. This guide shows practical Python patterns to control risk: volatility targeting, stop-losses, leverage caps, and drawdown kill switches—implemented in a minimal backtest you can extend.

Quickstart

- Define a risk budget (e.g., 10% annualized vol, 1.5× max leverage, 20% max drawdown).

- Choose simple entry/exit logic (e.g., trend via moving averages).

- Volatility-target your position size to meet the risk budget.

- Add execution realism: turnover-based costs and slippage.

- Add stop-loss and a drawdown kill switch.

- Evaluate: annual return, vol, Sharpe, max drawdown, turnover.

- Iterate: stress test, parameter sensitivity, and scenario analysis.

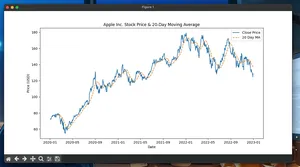

Minimal working example (single-asset, daily)

The example below simulates prices, trades a trend-following signal, and applies:

- Volatility targeting to meet a 10% annual vol budget

- Leverage cap (±1.5×)

- 5% trailing stop-loss

- 20% equity drawdown kill switch

- Turnover-based transaction costs

import numpy as np

import pandas as pd

def backtest(

n_days=1500,

seed=0,

mu_annual=0.08,

sigma_annual=0.20,

target_vol=0.10,

lookback_vol=20,

max_leverage=1.5,

stop_threshold=0.05, # 5% trailing stop

max_drawdown_kill=0.20,

cost_per_turnover=0.0002,

):

np.random.seed(seed)

ann_factor = 252

mu = mu_annual / ann_factor

sigma = sigma_annual / np.sqrt(ann_factor)

# Simulated daily returns and prices

rets = np.random.normal(mu, sigma, size=n_days)

price = 100 * np.exp(np.cumsum(rets))

idx = pd.date_range("2018-01-01", periods=n_days, freq="B")

df = pd.DataFrame({"price": price, "ret": rets}, index=idx)

# Simple signal: 50-day momentum (sign) with 1-day delay

mom = df.price.pct_change(50)

raw_signal = np.sign(mom).shift(1).fillna(0.0).to_numpy()

# Realized vol for scaling (annualized)

realized_vol = (

df.ret.rolling(lookback_vol).std() * np.sqrt(ann_factor)

).fillna(method="bfill").to_numpy()

# Arrays for simulation

pos = np.zeros(n_days)

daily_pnl = np.zeros(n_days)

equity = np.ones(n_days)

stopped = False

kill = False

peak = price[0]

trough = price[0]

highwater = 1.0

for t in range(1, n_days):

if kill:

pos[t] = 0.0

daily_pnl[t] = 0.0

equity[t] = equity[t - 1]

continue

# Volatility targeting (clip leverage)

vol = realized_vol[t]

desired = 0.0 if vol == 0 else raw_signal[t] * (target_vol / vol)

desired = float(np.clip(desired, -max_leverage, max_leverage))

# If previously stopped, wait for signal flip to re-enable

if stopped and raw_signal[t] == raw_signal[t - 1] and raw_signal[t] != 0:

desired = 0.0

# Apply trailing stop logic

prev_pos = pos[t - 1]

curr_pos = desired

# Opening a new position resets peaks/troughs

if prev_pos == 0.0 and curr_pos != 0.0:

peak = price[t]

trough = price[t]

stopped = False

# Update trailing levels

if prev_pos > 0:

peak = max(peak, price[t])

if price[t] < peak * (1 - stop_threshold):

curr_pos = 0.0

stopped = True

elif prev_pos < 0:

trough = min(trough, price[t])

if price[t] > trough * (1 + stop_threshold):

curr_pos = 0.0

stopped = True

# Transaction cost on turnover

turnover = abs(curr_pos - prev_pos)

daily_cost = cost_per_turnover * turnover

pos[t] = curr_pos

# PnL uses previous position exposure on today's return

strat_ret = prev_pos * df.ret.iloc[t] - daily_cost

daily_pnl[t] = strat_ret

equity[t] = equity[t - 1] * (1 + strat_ret)

# Drawdown kill switch

highwater = max(highwater, equity[t])

dd = (equity[t] / highwater) - 1

if dd < -max_drawdown_kill:

kill = True

pos[t] = 0.0

# Metrics

sr = daily_pnl.std()

ann_vol = float(sr * np.sqrt(ann_factor)) if sr > 0 else 0.0

mean = daily_pnl.mean()

ann_ret = float(mean * ann_factor)

sharpe = float((mean / sr) * np.sqrt(ann_factor)) if sr > 0 else 0.0

# Max drawdown

run_max = np.maximum.accumulate(equity)

dd = equity / run_max - 1

max_dd = float(dd.min())

avg_turnover = float(np.mean(np.abs(np.diff(pos))))

print("Annual return: %.2f%%" % (ann_ret * 100))

print("Annual vol: %.2f%%" % (ann_vol * 100))

print("Sharpe: %.2f" % sharpe)

print("Max drawdown: %.2f%%" % (max_dd * 100))

print("Avg daily turnover: %.4f" % avg_turnover)

return pd.DataFrame({"price": price, "pos": pos, "equity": equity}, index=idx)

if __name__ == "__main__":

backtest()

What to look for:

- Lower variance of equity if volatility targeting is effective

- Drawdown clamped near the kill switch threshold

- Realistic turnover and nonzero cost impact

Step-by-step implementation

- Set a risk budget

- Example: 10% annual vol, ±1.5× leverage, 5% trailing stop, 20% max drawdown.

- Build signal

- Keep it simple (trend, mean-reversion). Shift to avoid lookahead.

- Volatility targeting

- Weight = signal × target_vol / realized_vol, then clip to max leverage.

- Add stops

- Trailing or ATR-based; enforce a cool-off until signal flips.

- Add drawdown kill switch

- Flatten exposure after breaching portfolio-level drawdown.

- Model costs and slippage

- Use turnover × cost per unit turnover; stress test higher costs.

- Evaluate and iterate

- Track Sharpe, max drawdown, hit rate, exposure, turnover.

Common risk controls (what and why)

- Volatility targeting: stabilizes risk across regimes; prevents over-sizing in calm markets that later turn volatile.

- Leverage cap: hard bound on exposure; protects from vol estimation errors.

- Stop-loss (trailing or ATR): cuts tail risk and limits adverse excursions.

- Drawdown kill switch: protects portfolio survival; forces re-evaluation.

- Position/risk per trade: cap exposure per asset (e.g., ≤2% of equity at risk).

- Diversification limits: cap concentration and account for correlation spikes.

- Liquidity and size limits: cap notional/ADV and enforce participation caps.

Performance notes

- Vectorize indicator and volatility calculations with pandas/numpy; keep the state machine loop tight and on numpy arrays.

- Precompute rolling stats once; avoid redundant DataFrame operations inside loops.

- Use float32 where acceptable to reduce memory; profile with realistic horizons.

- For larger universes, batch operations, avoid Python loops per asset; consider numba for stateful logic.

- Cache signals and only update when the bar closes; avoid tick-level backtests unless necessary.

Pitfalls to avoid

- Lookahead bias: shift signals and use only past data for decisions.

- Survivorship bias: include delisted assets in historical tests when using real data.

- Overfitting: too many parameters or stop layers tuned to history.

- Ignoring correlation: portfolio risk can spike when assets move together.

- Underestimating costs: slippage and fees can erase edge; stress test.

- Volatility regime shifts: realized vol estimates can lag; use caps and decay.

Extensions

- Replace trailing stop with ATR-based stop: threshold = k × ATR.

- Add Value-at-Risk/Expected Shortfall caps to size positions under fat tails.

- Expand to multi-asset with risk-parity or volatility-bucket allocation.

- Add execution model: partial fills, delay, and market impact.

Tiny FAQ

- How do I pick target volatility?

- Start with a portfolio-level number you can stomach (e.g., 8–12% annual). Tune via backtests and stress tests.

- Vol targeting vs. leverage?

- Vol targeting determines desired leverage from recent volatility; a leverage cap bounds the result.

- Are stop-losses always helpful?

- They limit tail losses but can reduce returns in choppy markets. Test both on and off.

- Should I use Kelly sizing?

- Kelly is aggressive and sensitive to estimation error. Use a fraction (e.g., 0.25–0.5 Kelly) or prefer vol targeting.

- What metric best summarizes risk?

- Use several: max drawdown, Sharpe, volatility, and tail metrics (ES/VAR).