Overview

This guide shows how to implement the classic Turtle Trading system in Python for single-asset backtesting. It uses:

- Breakout entries: highest high (N) for long, lowest low (N) for short

- ATR-based position sizing (risk parity by volatility)

- Pyramiding: add units every 0.5 ATR up to a cap

- Exit on shorter lookback channel breakout in the opposite direction

Defaults mirror System 1: entry_lookback=20, exit_lookback=10. You can switch to 55/20 for slower System 2.

Minimal working example (single asset)

The example below generates synthetic OHLC data, computes signals, simulates executions with fee/slippage, and prints performance.

import numpy as np

import pandas as pd

np.random.seed(7)

# ---------- Synthetic OHLC data ----------

N = 1200 # trading days

ret = np.random.normal(0, 0.001, N)

close = 100 * (1 + pd.Series(ret)).cumprod()

high = close * (1 + np.random.uniform(0.0, 0.01, N))

low = close * (1 - np.random.uniform(0.0, 0.01, N))

open_ = close.shift(1).fillna(close.iloc[0])

df = pd.DataFrame({"Open": open_, "High": high, "Low": low, "Close": close})

# ---------- Indicators ----------

def wilder_atr(df, n=20):

h, l, c = df['High'], df['Low'], df['Close']

prev_c = c.shift(1)

tr = pd.concat([

(h - l),

(h - prev_c).abs(),

(l - prev_c).abs()

], axis=1).max(axis=1)

# Wilder's smoothing

return tr.ewm(alpha=1/n, adjust=False).mean()

entry_lookback = 20

exit_lookback = 10

atr_n = 20

atr = wilder_atr(df, n=atr_n)

# Donchian channels (shifted to avoid lookahead)

entry_high = df['High'].rolling(entry_lookback).max().shift(1)

entry_low = df['Low'].rolling(entry_lookback).min().shift(1)

exit_low = df['Low'].rolling(exit_lookback).min().shift(1)

exit_high = df['High'].rolling(exit_lookback).max().shift(1)

# ---------- Backtest ----------

init_cash = 100_000.0

risk_pct = 0.01 # risk 1% of equity per initial unit

max_units = 4

unit_add_atr = 0.5 # add a unit every 0.5 ATR

fee = 0.5 # per order, fixed

slip_bp = 1.0 # 1 bp slippage ≈ 0.01%

cash = init_cash

position = 0 # shares (can be negative if short)

units = 0 # number of units in current trade

last_add_price = np.nan # last add level for pyramiding

side = 0 # +1 long, -1 short, 0 flat

values = []

trades = []

def buy(shares, px):

global cash, position

trade_px = px * (1 + slip_bp/10_000)

cost = shares * trade_px + fee

cash -= cost

position += shares

return trade_px

def sell(shares, px):

global cash, position

trade_px = px * (1 - slip_bp/10_000)

proceeds = shares * trade_px - fee

cash += proceeds

position -= shares

return trade_px

unit_size = 0

for i in range(len(df)):

px = df['Close'].iloc[i]

a = atr.iloc[i]

eh, el = entry_high.iloc[i], entry_low.iloc[i]

xl, xh = exit_low.iloc[i], exit_high.iloc[i]

# Compute current equity/value first

value = cash + position * px

# Skip until indicators available

if pd.isna(a) or pd.isna(eh) or pd.isna(el) or pd.isna(xl) or pd.isna(xh):

values.append(value)

continue

# Exits

if side == 1 and px < xl:

# exit long

sell(position, px)

trades.append((i, 'exit_long', px))

side = 0; units = 0; unit_size = 0; last_add_price = np.nan

elif side == -1 and px > xh:

# exit short

buy(-position, px)

trades.append((i, 'exit_short', px))

side = 0; units = 0; unit_size = 0; last_add_price = np.nan

# Entries (only if flat)

if side == 0:

equity = cash # when flat, equity==cash

# ATR-dollar risk per share ≈ ATR (assuming $1 per point)

# Unit size = risk capital / ATR

u = int(max(1, (risk_pct * equity) // max(a, 1e-9)))

if px > eh: # long breakout

unit_size = u

buy(unit_size, px)

trades.append((i, 'enter_long', px))

side = 1; units = 1; last_add_price = px

elif px < el: # short breakdown

unit_size = u

sell(unit_size, px)

trades.append((i, 'enter_short', px))

side = -1; units = 1; last_add_price = px

# Pyramiding (after entry/while in trade)

if side == 1 and units > 0 and units < max_units and px >= last_add_price + unit_add_atr * a:

buy(unit_size, px)

trades.append((i, 'add_long', px))

units += 1

last_add_price = px

elif side == -1 and units > 0 and units < max_units and px <= last_add_price - unit_add_atr * a:

sell(unit_size, px)

trades.append((i, 'add_short', px))

units += 1

last_add_price = px

values.append(cash + position * px)

# Equity curve and metrics

curve = pd.Series(values, index=df.index)

ret = curve.pct_change().fillna(0)

def cagr(curve, periods=252):

total = curve.iloc[-1] / curve.iloc[0]

years = len(curve) / periods

return total ** (1/years) - 1

def sharpe(returns, periods=252):

mu, sd = returns.mean() * periods, returns.std() * np.sqrt(periods)

return mu / sd if sd > 0 else 0.0

def max_drawdown(curve):

roll_max = curve.cummax()

dd = curve / roll_max - 1

return dd.min()

print("Final equity:", round(curve.iloc[-1], 2))

print("CAGR:", round(cagr(curve)*100, 2), "%")

print("Sharpe:", round(sharpe(ret), 2))

print("Max DD:", round(max_drawdown(curve)*100, 2), "%")

print("Trades:", len(trades))

print(curve.tail())

What this does:

- Computes 20-day ATR and Donchian channels

- Enters on 20-day breakouts, exits on 10-day channels

- Sizes by ATR to target 1% capital risk per initial unit

- Adds up to 4 units, every 0.5 ATR in favor

- Reports equity, CAGR, Sharpe, and max drawdown

Quickstart

- Install prerequisites

- Python 3.9+

- pip install pandas numpy

- Drop in your own data

- Provide OHLC columns: Open, High, Low, Close indexed by date

# Example: load from CSV with columns Date,Open,High,Low,Close

prices = pd.read_csv("data.csv", parse_dates=["Date"], index_col="Date")

# Then reuse the indicator and backtest sections on `prices` instead of `df`.

- Tune parameters

- entry_lookback: 20 or 55

- exit_lookback: 10 or 20

- risk_pct: 0.5% to 2% typical

- max_units: 1–4

- unit_add_atr: 0.5 ATR classic

- Run and validate

- Check indicator alignment (shift to avoid lookahead)

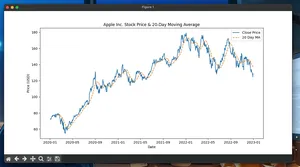

- Inspect trades and equity curve

Key parameters and defaults

| Parameter | Default | Meaning |

|---|---|---|

| entry_lookback | 20 | Days for breakout entry channel |

| exit_lookback | 10 | Days for exit channel |

| atr_n | 20 | ATR lookback for volatility |

| risk_pct | 0.01 | Fraction of equity risked per initial unit |

| max_units | 4 | Max pyramiding units per trade |

| unit_add_atr | 0.5 | Add a unit every this ATR move |

| fee | 0.5 | Fixed per-order fee |

| slip_bp | 1.0 | Slippage in basis points per trade |

Notes:

- For equities, “ATR-dollar per share” approximates ATR itself. For futures/FX, multiply by point value/contract size.

Pitfalls and gotchas

- Lookahead bias: Always shift channels by 1 bar. Never use today’s high/low to decide today’s entry.

- ATR warmup: ATR and channels are invalid until enough history exists. Skip trades until indicators are ready.

- Shorting constraints: The example allows shorting without borrow or fees. In production, include borrow availability and costs.

- Sizing realism: This example assumes fractional liquidity at mid with bp slippage. For small caps or crypto, use volume filters and conservative slippage.

- Pyramiding risk: Adding units increases exposure nonlinearly. Consider capping total risk or trailing stops.

- System 2 filter: Original rules skip a 55-day entry if the last 55-day breakout trade was profitable. If you implement it, track per-market last outcome.

- Transaction costs: Results are sensitive to fees and slippage; stress test these.

Performance notes

- Vectorize indicators: rolling and ewm are fast in pandas. Avoid Python loops for indicator calc; use loops only where path dependence exists (position management).

- Pre-allocate: Store arrays (numpy) for value/position to reduce overhead.

- numba: JIT-compile the trade loop for 3–20x speedup on large datasets.

- Multiple symbols: Process per symbol, then concatenate results. Avoid iterrows; prefer iloc with integer indices.

- Memory: For long histories, store only needed series (Close, High, Low, ATR, channels) and write detailed trades to disk.

Variations

- System 2: entry_lookback=55, exit_lookback=20, with the “no new entry after profitable trade” filter.

- Long-only: Disable shorts for markets where shorting is impractical.

- Risk model: Use volatility target per portfolio (e.g., 10% annualized) and scale exposure accordingly.

- Portfolio: Trade multiple, uncorrelated markets and cap per-market risk to diversify.

FAQ

Q: Why ATR for position sizing? A: It scales exposure inversely to volatility so each trade risks similar dollars.

Q: What timeframes work best? A: Daily bars are standard. Intraday works, but costs and noise increase.

Q: How many units should I add? A: Classic is up to 4 units at 0.5 ATR spacing. Fewer units reduce risk/turnover.

Q: Can I use adjusted prices? A: Use unadjusted High/Low for channels and ATR; Close can be adjusted for PnL consistency.

Q: How do I avoid overfitting? A: Keep canonical parameters (20/10 or 55/20), test out-of-sample, and limit degrees of freedom.