Overview

This guide shows how to detect MACD positive (bullish) and negative (bearish) divergence in Python using pandas and NumPy. We compute MACD, extract price/oscillator swing points (pivots), align them, and flag divergences.

- Positive (bullish) divergence: price makes a lower low, MACD makes a higher low.

- Negative (bearish) divergence: price makes a higher high, MACD makes a lower high.

You can test on daily data from yfinance and adapt to intraday feeds.

Quickstart

- Load OHLC data and compute the MACD line (or histogram) with EMAs.

- Detect swing highs/lows in both price and MACD via a local window.

- Align price pivots with nearby MACD pivots within a tolerance of bars.

- Compare consecutive pivot pairs to flag divergences.

- Review events, tune window and tolerance, and integrate into backtests.

Minimal working example

# pip install pandas numpy yfinance

import numpy as np

import pandas as pd

import yfinance as yf

# ----- Indicators -----

def macd(close: pd.Series, fast=12, slow=26, signal=9):

ema_fast = close.ewm(span=fast, adjust=False).mean()

ema_slow = close.ewm(span=slow, adjust=False).mean()

macd_line = ema_fast - ema_slow

signal_line = macd_line.ewm(span=signal, adjust=False).mean()

hist = macd_line - signal_line

return macd_line, signal_line, hist

# ----- Pivot detection (swing points) -----

def pivots(series: pd.Series, window=5, kind='low') -> np.ndarray:

# A pivot must be strictly lower/higher than its neighbors in a 2*window+1 range

arr = series.values

n = len(arr)

out = []

for i in range(window, n - window):

segment = arr[i - window:i + window + 1]

center = arr[i]

if kind == 'low':

if center == segment.min() and center < segment[:window].min() and center < segment[window+1:].min():

out.append(i)

else: # 'high'

if center == segment.max() and center > segment[:window].max() and center > segment[window+1:].max():

out.append(i)

return np.array(out, dtype=int)

# Map each price pivot to the nearest oscillator pivot within max_lag bars

def align_pivots(price_idxs: np.ndarray, osc_idxs: np.ndarray, max_lag=3):

mapping = {}

if len(osc_idxs) == 0:

return mapping

for pi in price_idxs:

j = int(np.argmin(np.abs(osc_idxs - pi)))

if abs(int(osc_idxs[j]) - int(pi)) <= max_lag:

mapping[int(pi)] = int(osc_idxs[j])

return mapping

# ----- Divergence detection -----

def find_divergences(close: pd.Series, osc: pd.Series, window=5, max_lag=3, lookback=300):

price_lows = pivots(close, window, 'low')

price_highs = pivots(close, window, 'high')

osc_lows = pivots(osc, window, 'low')

osc_highs = pivots(osc, window, 'high')

low_map = align_pivots(price_lows, osc_lows, max_lag)

high_map = align_pivots(price_highs, osc_highs, max_lag)

events = []

# Bullish divergence: price lower low, osc higher low

low_keys = sorted(low_map.keys())

for i in range(1, len(low_keys)):

p1, p2 = low_keys[i-1], low_keys[i]

if p2 < len(close) and p2 >= max(0, len(close) - lookback):

if close.iloc[p2] < close.iloc[p1] and osc.iloc[low_map[p2]] > osc.iloc[low_map[p1]]:

events.append({

'type': 'bullish',

'price_idx1': p1, 'price_idx2': p2,

'osc_idx1': low_map[p1], 'osc_idx2': low_map[p2]

})

# Bearish divergence: price higher high, osc lower high

high_keys = sorted(high_map.keys())

for i in range(1, len(high_keys)):

p1, p2 = high_keys[i-1], high_keys[i]

if p2 < len(close) and p2 >= max(0, len(close) - lookback):

if close.iloc[p2] > close.iloc[p1] and osc.iloc[high_map[p2]] < osc.iloc[high_map[p1]]:

events.append({

'type': 'bearish',

'price_idx1': p1, 'price_idx2': p2,

'osc_idx1': high_map[p1], 'osc_idx2': high_map[p2]

})

return events

# ----- Example run -----

# Download daily data, compute MACD, and find divergences

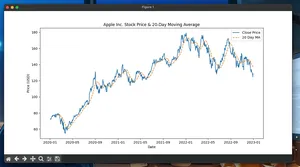

symbol = 'AAPL'

df = yf.download(symbol, period='2y', interval='1d', auto_adjust=True, progress=False)

close = df['Close']

macd_line, signal_line, hist = macd(close)

osc = macd_line # you can try 'hist' as well

events = find_divergences(close, osc, window=5, max_lag=3, lookback=350)

# Show the last few events

for e in events[-5:]:

p1d = close.index[e['price_idx1']]

p2d = close.index[e['price_idx2']]

print(

e['type'].upper(),

'from', p1d.date(), 'to', p2d.date(),

'| price:', round(float(close.iloc[e['price_idx1']]), 2), '→', round(float(close.iloc[e['price_idx2']]), 2),

'| MACD:', round(float(osc.iloc[e['osc_idx1']]), 4), '→', round(float(osc.iloc[e['osc_idx2']]), 4)

)

What counts as divergence

| Divergence | Price pivots | MACD pivots |

|---|---|---|

| Positive (bullish) | Lower low (LL) | Higher low (HL) |

| Negative (bearish) | Higher high (HH) | Lower high (LH) |

Tip: You can use either the MACD line or the histogram. The histogram often reacts faster but is noisier.

Step-by-step algorithm

- Compute MACD line: EMA(fast) − EMA(slow). Optionally compute the histogram: MACD − signal.

- Find pivots for price and MACD with a symmetric window of k bars on each side.

- Align each price pivot to the nearest MACD pivot within max_lag bars (tolerance).

- Iterate through consecutive price pivots of the same kind (two lows or two highs).

- Compare directions: LL + HL → bullish; HH + LH → bearish. Record event indices and dates.

Tuning parameters

- window: how strict a pivot is (larger = fewer, more reliable pivots). Start with 3–7.

- max_lag: maximum bar distance to match MACD pivot to price pivot (2–5 typical).

- MACD variant: try macd_line vs hist. Histogram may surface earlier signals.

- lookback: limit processing to recent bars for speed.

Interpreting results

- Divergence suggests potential momentum exhaustion, not guaranteed reversals.

- Combine with confirmation (trend filters, break of structure, volume, or RSI).

- Expect multiple signals; filter by trend regime or minimum MACD amplitude difference.

Pitfalls to avoid

- Repainting pivots: a pivot is only confirmed after window bars pass. Do not act on the current bar’s partial pivot.

- Overfitting window/max_lag to a single asset or timeframe.

- Misalignment: matching pivots with no time tolerance creates false negatives; too large tolerance creates false positives.

- Equal highs/lows: flat pivots can confuse strict comparisons. Consider ≥ or ≤ if needed.

- Using highs/lows vs closes: the code uses closes; for wick-based pivots, switch to High/Low.

- Regime dependency: divergences in strong trends can fail repeatedly.

Performance notes

- Complexity: O(n * window) due to pivot scan loops. With small window, this is fast for typical daily/intraday datasets.

- Vectorization: For very large datasets, consider vectorized extrema detection using rolling windows or stride tricks, or use numba to JIT the pivot loop.

- Memory: Keep only arrays you need (close and chosen oscillator). Avoid copying full OHLC if unused.

- Batch processing: Precompute EMAs once per symbol; reuse for multiple scans.

- Streaming: Maintain rolling buffers and update EMA incrementally to avoid recomputing from scratch.

Variations and extensions

- Confirmation filter: require MACD cross of signal after divergence.

- Strength filter: enforce min distance between pivots or min MACD difference.

- Multi-timeframe: confirm a 5m divergence with a 1h trend filter.

- Histogram-based: simply set osc = hist in the example to switch.

FAQ

Which is better, MACD line or histogram?

- Histogram reacts sooner but is noisier. MACD line is smoother. Test both.

Why do signals appear late?

- Pivots are confirmed only after window bars close; this prevents repainting but adds latency.

Can this run intraday?

- Yes. Use intraday intervals and adjust window and max_lag to the timeframe’s noise level.

How do I reduce false positives?

- Increase window, require larger MACD differences, add trend/volume filters, and confirm with price action.