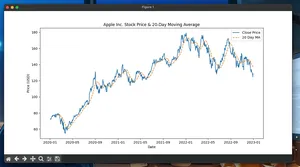

Overview

The Moving Average Convergence Divergence (MACD) is a momentum indicator widely used in systematic strategies. It is defined as:

- MACD line = EMA(fast) − EMA(slow)

- Signal line = EMA(signal) of MACD line

- Histogram = MACD line − Signal line

Typical parameters are (fast, slow, signal) = (12, 26, 9) on closing prices.

| Component | Definition | Typical span |

|---|---|---|

| MACD line | EMA(12) − EMA(26) | 12, 26 |

| Signal line | EMA of MACD line | 9 |

| Histogram | MACD − Signal | — |

Quickstart

- Install dependencies

pip install pandas numpy yfinance

Load price data (Close), ideally adjusted for splits/dividends.

Compute MACD with pandas ewm and adjust=False.

Create a position rule (e.g., long when MACD > Signal; short otherwise).

Backtest with next-bar execution to avoid lookahead bias.

Review metrics and iterate on parameters.

Minimal working example (single asset, daily)

import numpy as np

import pandas as pd

import yfinance as yf

# 1) Download daily data

symbol = "SPY"

df = yf.download(symbol, period="2y", interval="1d", auto_adjust=True, progress=False)

close = df["Close"].rename(symbol)

# 2) MACD computation

def compute_macd(price: pd.Series, fast: int = 12, slow: int = 26, signal: int = 9) -> pd.DataFrame:

ema_fast = price.ewm(span=fast, adjust=False).mean()

ema_slow = price.ewm(span=slow, adjust=False).mean()

macd_line = ema_fast - ema_slow

signal_line = macd_line.ewm(span=signal, adjust=False).mean()

hist = macd_line - signal_line

out = pd.DataFrame({

"macd": macd_line,

"signal": signal_line,

"hist": hist,

})

return out

macd = compute_macd(close)

# 3) Simple long-short strategy using histogram sign

ret = close.pct_change()

position = np.where(macd["hist"] > 0, 1, -1)

position = pd.Series(position, index=close.index)

# 4) Next-bar execution (shift signal by 1 day)

strategy_ret = ret * position.shift(1)

# 5) Clean warm-up region (drop early NaNs from EMAs)

strategy_ret = strategy_ret.dropna()

ret = ret.loc[strategy_ret.index]

# 6) Metrics

cum_strategy = (1 + strategy_ret).cumprod()

cum_buyhold = (1 + ret).cumprod()

def sharpe(r, freq=252):

return np.sqrt(freq) * r.mean() / r.std(ddof=0)

print("Final strategy equity:", float(cum_strategy.iloc[-1]))

print("Final buy&hold equity:", float(cum_buyhold.iloc[-1]))

print("Sharpe (strategy):", float(sharpe(strategy_ret)))

print("Sharpe (buy&hold):", float(sharpe(ret)))

# Inspect latest MACD values

print(macd.tail())

Notes:

- adjust=False aligns with most trading tools and avoids bias from historical reweighting.

- We shifted the position by one bar to simulate trading on the next close/open.

Implementation details

- Exponentially weighted mean: pandas.Series.ewm(span=s, adjust=False).mean() uses alpha = 2 / (s + 1).

- Warm-up: EMAs need multiple bars to stabilize. Expect NaNs early; drop or ignore the initial period.

- Parameter intuition:

- Larger slow span smooths more, reduces false signals, reacts later.

- Smaller fast span increases responsiveness, may increase noise.

Common signal rules

- Crossover: go long when MACD crosses above Signal; exit/short when below.

- Histogram sign: long if hist > 0; short if hist < 0.

- Zero-line filter: trade only when MACD is above/below 0 to align with broader trend.

Example crossover detection (without full backtest):

cross_up = (macd["macd"] > macd["signal"]) & (macd["macd"].shift(1) <= macd["signal"].shift(1))

cross_dn = (macd["macd"] < macd["signal"]) & (macd["macd"].shift(1) >= macd["signal"].shift(1))

entry_dates = macd.index[cross_up]

exit_dates = macd.index[cross_dn]

Multi-asset example (vectorized)

# Suppose we have multiple symbols

symbols = ["SPY", "QQQ", "IWM"]

px = yf.download(symbols, period="2y", interval="1d", auto_adjust=True, progress=False)["Close"]

# Stack to long format and groupby compute MACD per symbol

long_px = px.stack().rename("close").to_frame()

long_px.index.names = ["date", "symbol"]

def macd_grouped(g):

out = compute_macd(g["close"]).dropna()

return out

macd_long = long_px.groupby(level="symbol", group_keys=False).apply(macd_grouped)

Pitfalls to avoid

- Lookahead bias: never use today’s close to decide today’s trade at that same close; shift signals by one bar.

- EMA parameters mismatch: pandas ewm(span=s, adjust=False) matches common charting defaults. Using adjust=True or halflife will differ.

- Data gaps and corporate actions: use adjusted prices; forward-fill only when appropriate.

- Intraday to daily mixing: resample carefully; confirm timezones and market sessions.

- Warm-up contamination: exclude early bars where EMAs are not stabilized.

- Slippage/fees: include costs; MACD flip-flopping can be costly in choppy markets.

Performance notes

- Vectorize: use pandas/numpy operations; avoid Python loops.

- Batch symbols: compute by groupby over a long DataFrame rather than iterating.

- Memory: drop unused columns and downcast to float32 when many symbols are used.

- Rolling windows: EMA is O(n); computing on large intraday histories is cheap; IO may dominate.

- Parallelism: batch downloads and use multiprocessing for backtests if CPU-bound.

- JIT option: for ultra-low latency, a Numba-compiled EMA can reduce Python overhead, though pandas ewm is typically sufficient.

Validation checklist

- Does MACD(12,26,9) match your charting platform? If not, confirm adjust=False.

- Are signals shifted to the next bar in backtests?

- Are metrics robust to transaction costs and parameter changes?

- Have you tested across regimes (trending vs. mean-reverting)?

Tiny FAQ

Which price should I use?

- Close is standard. For intraday, typical is last traded price per bar; ensure consistency.

How do I match TradingView/TA-Lib values?

- Use adjust=False with spans (12,26,9). Small differences can still occur due to rounding or data vendor differences.

Why is my first MACD value NaN?

- EMAs need warm-up. Drop the initial period or ignore until stabilized.

Can I use MACD intraday?

- Yes. Compute on 1m/5m bars. Ensure latency assumptions and costs reflect reality.

How do I avoid whipsaws?

- Add a threshold on the histogram, confirm with a higher-timeframe trend, or require persistence over N bars.

Is MACD better long-only or long-short?

- Depends on asset and regime. Test both, include costs, and validate out of sample.